Labour Market Bulletin - Alberta: October 2022

This Labour Market Bulletin provides an analysis of Labour Force Survey results for the province of Alberta, including the regions of Calgary, Edmonton, Central Alberta and Mountain Parks, Southern Alberta, and Northern Alberta.

Overview

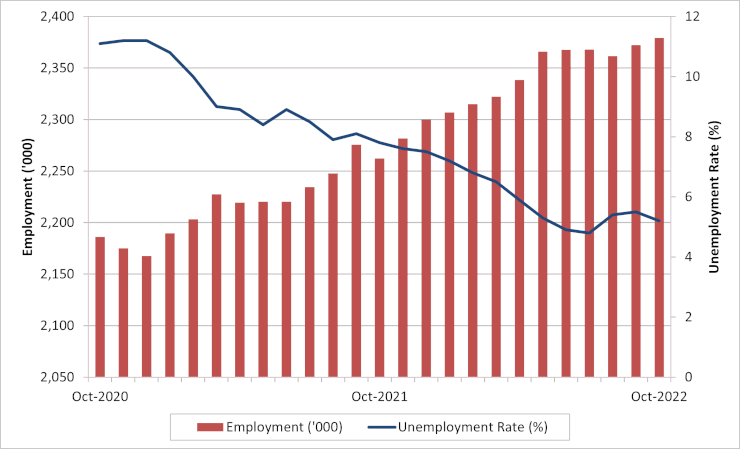

Despite negative economic factors such as high inflation and increased base-line interest rates, employment was still slightly up in Alberta in October. Overall employment increased by 6,900 jobs (+0.3%) in October. Full-time employment increased by 14,000 jobs (+0.7%), whereas part-time employment decreased by 7,200 jobs (-1.6%).

| Seasonally Adjusted Monthly Data |

October 2022 | September 2022 | October 2021 | Monthly Variation | Yearly Variation | ||

|---|---|---|---|---|---|---|---|

| Number | % | Number | % | ||||

| Population 15 + ('000) | 3,648.8 | 3,637.8 | 3,556.1 | 11.0 | 0.3 | 92.7 | 2.6 |

| Labour Force ('000) | 2,509.1 | 2,509.4 | 2,453.5 | -0.3 | 0.0 | 55.6 | 2.3 |

| Employment ('000) | 2,379.2 | 2,372.3 | 2,262.1 | 6.9 | 0.3 | 117.1 | 5.2 |

| Full-Time ('000) | 1,930.7 | 1,916.7 | 1,850.4 | 14.0 | 0.7 | 80.3 | 4.3 |

| Part-Time ('000) | 448.5 | 455.7 | 411.7 | -7.2 | -1.6 | 36.8 | 8.9 |

| Unemployment ('000) | 129.9 | 137.0 | 191.4 | -7.1 | -5.2 | -61.5 | -32.1 |

| Unemployment Rate (%) | 5.2 | 5.5 | 7.8 | -0.3 | - | -2.6 | - |

| Participation Rate (%) | 68.8 | 69.0 | 69.0 | -0.2 | - | -0.2 | - |

| Employment Rate (%) | 65.2 | 65.2 | 63.6 | 0.0 | - | 1.6 | - |

* Totals may not add due to rounding

Source: Statistics Canada Labour Force Survey – Table 14-10-0287, formerly CANSIM 282-0087

While the province has been experiencing an economic windfall recently, labour shortages in key sectors, especially the healthcare sector, continue to threaten growth. The provincial government has taken several actions to help alleviate the persistent labour shortages that have plagued the health care sector in recent months. In mid-October, the Government of Alberta and the Philippines signed an agreement to assist in the recruitment of internationally educated registered nurses and licensed practical nurses to the province. [1] Also in October, Alberta Health Services (AHS) announced that it had filled 355 positions, including nurses, allied health professionals and pharmacists, to support 50 new critical care beds in intensive care units (ICUs) at hospitals across the province. [2] While these are positive developments, there still remains labour shortages throughout the health care sector that are affecting the quality of health care delivery in many different regions of the province.

Seasonally adjusted data

Source: Statistics Canada Labour Force Survey Table 14-10-0287

Show data table: Alberta Monthly Employment and Unemployment Rate

| Unemployment Rate (%) | Employment ('000) | |

|---|---|---|

| Oct-2020 | 11.1 | 2,186.0 |

| Nov-2020 | 11.2 | 2,175.1 |

| Dec-2020 | 11.2 | 2,167.6 |

| Jan-2021 | 10.8 | 2,189.5 |

| Feb-2021 | 10.0 | 2,203.2 |

| Mar-2021 | 9.0 | 2,227.4 |

| Apr-2021 | 8.9 | 2,219.5 |

| May-2021 | 8.4 | 2,220.1 |

| Jun-2021 | 8.9 | 2,220.3 |

| Jul-2021 | 8.5 | 2,234.5 |

| Aug-2021 | 7.9 | 2,247.7 |

| Sep-2021 | 8.1 | 2,275.4 |

| Oct-2021 | 7.8 | 2,262.1 |

| Nov-2021 | 7.6 | 2,281.7 |

| Dec-2021 | 7.5 | 2,299.8 |

| Jan-2022 | 7.2 | 2,306.8 |

| Feb-2022 | 6.8 | 2,315.0 |

| Mar-2022 | 6.5 | 2,322.2 |

| Apr-2022 | 5.9 | 2,338.2 |

| May-2022 | 5.3 | 2,365.7 |

| Jun-2022 | 4.9 | 2,367.7 |

| Jul-2022 | 4.8 | 2,368.0 |

| Aug-2022 | 5.4 | 2,361.5 |

| Sep-2022 | 5.5 | 2,372.3 |

| Oct-2022 | 5.2 | 2,379.2 |

The health care sector is not the only sector that is dealing with acute labour shortages. For instance, school bus drivers continue to be in short supply in Calgary despite ongoing recruitment and retention campaigns from transportation providers. More than 50 bus routes are without drivers across the public and catholic school systems. In Alberta, the Catholic school system is under provincial jurisdiction. [3] In Late October, the City of Wetaskiwin announced that it had to reduce service levels at its indoor pool at the Manluk Centre: Wetaskiwin Regional Aquatics and Fitness until at least the end of November 2022 due to a shortage of lifeguards. [4] A tight labour market has made it extremely difficult to fill many vacant positions in various sectors across the province, where the unemployment rate remains very low at 5.2%.

| Seasonally Adjusted Data | October 2022 (%) |

September 2022 (%) |

October 2021 (%) |

Monthly Variation (% points) |

Yearly Variation (% points) |

|---|---|---|---|---|---|

| Total | 5.2 | 5.5 | 7.8 | -0.3 | -2.6 |

| 25 years and over | 4.4 | 4.8 | 7.0 | -0.4 | -2.6 |

| Men - 25 years and over | 4.2 | 4.8 | 6.7 | -0.6 | -2.5 |

| Women - 25 years and over | 4.8 | 4.8 | 7.4 | 0.0 | -2.6 |

| 15 to 24 years | 10.0 | 9.9 | 12.8 | 0.1 | -2.8 |

| Men - 15 to 24 years | 10.1 | 11.4 | 16.6 | -1.3 | -6.5 |

| Women - 15 to 24 years | 9.9 | 8.3 | 8.9 | 1.6 | 1.0 |

* Totals may not add due to rounding

Source: Statistics Canada Labour Force Survey – Table 14-10-0287, formerly CANSIM 282-0087

Young women (aged 15-24 years) had the most significant increase in their unemployment rate, with a 1.6 percentage point increase compared to last month. Young men (aged 15-24 years) on the other hand saw a decrease in the unemployment rate of 1.3 percentage points. However, young men also had the highest unemployment rate of any of the age and gender groups at 10.1%. The unemployment rate for young workers (15-24 years) was at 10.0% in October, compared to 4.4% for workers 25 years and over.

Employment by industry

Employment in both the goods-producing sector and the services-producing sector was up marginally in October. In the goods-producing sector, employment increased by about +1,300 jobs (+0.2%). Meanwhile, employment in the services-producing sector increased slightly by 5,500 jobs (+0.3). Both the goods-producing and services-producing sector have experienced substantial employment growth on an annual basis with increases of 32,900 jobs (+6.2%) and 84,200 jobs (+4.9%) respectively.

| Seasonally Adjusted Data ('000) |

October 2022 | September 2022 | October 2021 | Monthly Variation | Yearly Variation | ||

|---|---|---|---|---|---|---|---|

| Number | % | Number | % | ||||

| Total employed, all industries | 2,379.2 | 2,372.3 | 2,262.1 | 6.9 | 0.3 | 117.1 | 5.2 |

| Goods-producing sector | 560.9 | 559.6 | 528.0 | 1.3 | 0.2 | 32.9 | 6.2 |

| Agriculture | 43.0 | 41.2 | 33.7 | 1.8 | 4.4 | 9.3 | 27.6 |

| Forestry, fishing, mining, quarrying, oil and gas | 140.6 | 142.8 | 141.6 | -2.2 | -1.5 | -1.0 | -0.7 |

| Utilities | 21.5 | 23.6 | 18.3 | -2.1 | -8.9 | 3.2 | 17.5 |

| Construction | 230.0 | 226.6 | 214.7 | 3.4 | 1.5 | 15.3 | 7.1 |

| Manufacturing | 125.8 | 125.2 | 119.6 | 0.6 | 0.5 | 6.2 | 5.2 |

| Services-producing sector | 1,818.3 | 1,812.8 | 1,734.1 | 5.5 | 0.3 | 84.2 | 4.9 |

| Trade | 377.0 | 373.1 | 353.1 | 3.9 | 1.0 | 23.9 | 6.8 |

| Transportation and warehousing | 130.5 | 132.9 | 135.6 | -2.4 | -1.8 | -5.1 | -3.8 |

| Finance, insurance, real estate and leasing | 119.0 | 122.3 | 121.2 | -3.3 | -2.7 | -2.2 | -1.8 |

| Professional, scientific and technical services | 224.5 | 222.2 | 191.1 | 2.3 | 1.0 | 33.4 | 17.5 |

| Business, building and other support services | 70.8 | 72.6 | 72.3 | -1.8 | -2.5 | -1.5 | -2.1 |

| Educational services | 159.9 | 159.4 | 171.2 | 0.5 | 0.3 | -11.3 | -6.6 |

| Health care and social assistance | 312.4 | 311.7 | 301.1 | 0.7 | 0.2 | 11.3 | 3.8 |

| Information, culture and recreation | 77.2 | 76.4 | 68.8 | 0.8 | 1.0 | 8.4 | 12.2 |

| Accommodation and food services | 136.0 | 133.6 | 120.3 | 2.4 | 1.8 | 15.7 | 13.1 |

| Other services | 105.2 | 104.5 | 91.7 | 0.7 | 0.7 | 13.5 | 14.7 |

| Public administration | 105.9 | 104.2 | 107.9 | 1.7 | 1.6 | -2.0 | -1.9 |

* Totals may not add due to rounding

Source: Statistics Canada Labour Force Survey – Table 14-10-0355, formerly CANSIM 282-0088

Goods-producing industries

While increased demand, relatively high energy prices and record levels of oil production supported job growth in the resource extraction sector (forestry, mining, and oil and gas) sector in recent months, recent decreases in the prices of Western Canadian Select (WCS) have softened the outlook for the sector. The prices of WCS has decreased for the fifth month in a row In October, the price of WCS was $61.01 $USD/barrel, down 37 percentage points from the annual high that was set in May. Employment in the resource extraction decreased by -2,200 jobs (-1.5%) in October. Labour shortages have also plagued the sector in recent months. Industry-wide labour shortages in the energy servicing sector have resulted in some member companies of the Canadian Association of Energy Contractors (CAOEC) turning down work from clients. Companies have been increasing wages and recruiting from other provinces to help overcome the labour shortages. [5]

Employment in the construction sector increased by 3,400 jobs (+1.5%). On an annual basis, employment has increased by +15,300 (+7.1%). Despite the monthly employment increase, construction intentions have dampened in recent months. After a decrease of -9.2% in August, the seasonally adjusted value of building permits issued by Alberta municipalities was down by 11.9% in September. [6] Still, the governments of Alberta and Canada announced that they are providing a combined $476M towards Air Products' new $1.6B natural gas to hydrogen production facility to be built near Edmonton. The facility is expected to create 2,500 construction jobs and 30 permanent jobs once operational by the end of 2024. [7] Additionally, Northland Power announced that it is planning a new wind turbine project, named Pihew Waciy Wind, near St. Paul. Construction is projected in the spring to fall of 2024, and possibly into the summer of 2025. Up to 150 construction jobs will be available during the peak of construction and four to six permanent jobs for ongoing operations and maintenance are forecast once the project is up and running. Projects such as these should help support job growth in the sector in the short to medium term.

Services-producing industries

The services-producing sector includes labour intensive and public-facing industries such as wholesale and retail trade, and food and accommodation. These industries were initially among the most impacted during the height of COVID-19 related closures. In recent months employment has begun to recover.

There have been severe labour shortages in the health care and social assistance sector that have affected service delivery in many different regions of Alberta. In October, employment in the sector saw a negligible increase of 700 jobs (+0.2%). The City of Lethbridge and the surrounding area will be serviced by just one permanent obstetrician-gynecologist by the end of November 2022 due to an ongoing shortage of physicians. Alberta Health Services (AHS) provides funding for eight obstetrician-gynecologists, but some doctors have closed their practices altogether and some are on leave. [8] Attempts are being made at alleviating the labour shortages within the sector. In October, AHS was in the process of filling 14 RN and LPN positions at the Red Deer Hospital, along with two new anesthesiologists. Another five recruits were in various stages of assessments and credentialing. AHS is working with a recruitment agency to bring in additional international medical graduates. [9] In October, the Lloydminster Hospital was looking for two full-time registered nurses and two part-time RNs. Other position openings included a part-time clinical nurse educator, a casual unit clerk, a manager of health information management and a full-time medical lab technologist. [10]

Regional analysis

The statistics for the economic regions are not seasonally adjusted and should only be compared on a year-over-year basis. Employment is sometimes influenced by seasonal and calendar effects occurring at the same time and with the same magnitude every year, which can bring about changes in the data that make quarterly comparisons difficult.

In October, employment increased on an annual basis in every economic region except Lethbridge - Medicine Hat. The largest job gains occurred in Camrose-Drumheller (+11.5%).

| 3-Month Moving Averages Seasonally Unadjusted Data |

Employment | Unemployment Rate | ||||

|---|---|---|---|---|---|---|

| October 2022 ('000) |

October 2021 ('000) |

Yearly Variation (%) |

October 2022 (%) |

October 2021 (%) |

Yearly Variation (% points) |

|

| Alberta | 2,384.8 | 2,276.3 | 4.8 | 5.2 | 7.7 | -2.5 |

| Economic Regions | ||||||

| Lethbridge - Medicine Hat | 144.2 | 145.5 | -0.9 | 3.3 | 5.3 | -2.0 |

| Camrose - Drumheller | 102.6 | 92.0 | 11.5 | 5.6 | 10.2 | -4.6 |

| Calgary | 951.2 | 887.3 | 7.2 | 5.6 | 8.2 | -2.6 |

| Banff-Jasper-Rocky Mountain House and Athabasca-Grand Prairie-Peace River |

181.2 | 175.9 | 3.0 | 5.7 | 7.1 | -1.4 |

| Red Deer | 109.1 | 105.0 | 3.9 | 5.5 | 7.8 | -2.3 |

| Edmonton | 825.2 | 799.5 | 3.2 | 4.9 | 7.7 | -2.8 |

| Wood Buffalo - Cold Lake | 71.1 | 71.0 | 0.1 | 5.7 | 6.2 | -0.5 |

* Totals may not add due to rounding

Source: Statistics Canada Labour Force Survey – Table 14-10-0387, formerly CANSIM 282-0122

Lethbridge – Medicine Hat was the only region in Alberta to see an employment decrease in October, seeing a drop of 1,300 jobs (-0.9%) on an annual basis. However, there have been positive announcements of job creation in the region recently: In early October, Lethbridge-based Southland Trailer Corp. announced that it would be doubling its production and adding 250 jobs at an expanded manufacturing facility following a $2.06M contribution from the province through the Investment and Growth Fund. [11] Additionally, the governments of Alberta and Canada are partnering to build 14 housing units in Lethbridge for Blackfoot women and their children who are relocating from the Kainai, Siksika and Piikani reserves. The joint funding for the $3.4M project is expected to create about 25 jobs. [12]

In the Camrose – Drumheller region, employment increased by 10.600 jobs (+11.5%). This was the largest increase on a percentage basis of any region in Alberta. There has been some positive news in the health care sector in the region, which has struggled with staff shortages throughout the last few months. Construction is underway on a new DynaLIFE Patient Service Centre in Strathmore that will provide community laboratory services under a broader transition plan by Alberta Health Services. A temporary site will operate to provide patient services pending the completion of construction. [13]

Employment in Banff – Jasper – Rocky Mountain House and Athabasca – Grande Prairie – Peace River increased by 5,300 jobs (+3.0%) in October. The region is largely driven by employment in the tourism sectors, which have recently had a hard time recruiting workers. In September, there were about 5, 000 vacant jobs in Banff, Canmore and the surrounding ski hills. [14] In October, local ski resorts and the tourism industry as a whole in the Banff region were looking for workers to fill a wide range of occupations, including ski instructors, lift attendants, kitchen staff, shuttle bus drivers, guest service agents and more. [15]

In Red Deer employment increased by 4,100 jobs (+3.9%) on an annual basis in October. In positive news for the region, PACE Canada LP has started construction on a 47-megawatt solar plant at Joffre, located next to the Nova Chemical petrochemical complex. The facility is the first of four advanced utility-scale solar projects PACE is developing in Alberta. [16] Nevertheless, like all regions in Alberta, the Red Deer region has faced acute labour shortages over the last few months. In response to this, the Town of Innisfail has been recognized as a designated community under the Alberta Advantage Immigration Program. Under the program, employers in designated communities can directly recruit immigrant workers to fill new labour requirements. The town is also partnering with a group to help retain newcomers by sharing information about local settlement services. [17]

Employment in Wood Buffalo – Cold Lake essentially stayed the same on an annual basis in October. In a blow to employment prospects in the region, Suncor Energy Inc. announced that it is reducing the size of its contractor work force by 20 per cent to improve safety and performance at its oilsands operations. More than half of the work force reductions have already been completed, with the balance to be completed by the first half of 2023. [18] On a positive note, Northland Power is planning a new wind turbine project, named Pihew Waciy Wind, near St. Paul. Construction is projected in the spring to fall of 2024, and possibly into the summer of 2025. Up to 150 construction jobs will be available during the peak of construction and four to six permanent jobs for ongoing operations and maintenance. [19] There was also positive news in regards to the ongoing labour shortages that are affecting the region. Fort McMurray is now part of the Rural Renewal Stream, a provincial program that helps recruit foreign nationals to live, work and settle in rural communities. Local labour shortages are prevalent in the hospitality sector, specialized trades and trained heavy equipment operators. [20]

The Calgary region saw an employment increase of 63,900 jobs (+7.2%). There has been a couple of positive announcements regarding job growth in multiple sectors recently. Firstly, the Calgary International Airport was hiring for a range of positions in October, including pre-board screening officer, ramp agent, customer service agent, heavy equipment technician and aircraft refueller. [21] Additionally, Sidetrade, a France-based global artificial intelligence company offering business-to-business services, is opening a new headquarters in Calgary for its North America operations. Sidetrack is investing $24M in the office with plans to create 110 new jobs over the next three years with a commitment to hiring locally. [22]

In Edmonton, employment was up by 25,700 jobs (+3.2%) in October. There have been positive announcements regarding job growth in the region recently. For instance, the governments of Alberta and Canada are providing a combined $476M towards Air Products' new $1.6B natural gas to hydrogen production facility to be built near Edmonton. The facility is expected to create 2,500 construction jobs and 30 permanent jobs once operational by the end of 2024. [23] Also, the Paul First Nation is partnering with the provincial and federal governments and the City of Edmonton to build 24 new affordable rental and rent-to-own units for its members. The project is expected to create about 50 jobs. [24]

Footnotes

-

Government of Alberta (October 6, 2022) Agreement aims to bring more nurses to Alberta ↑

-

Government of Alberta (October 6, 2022) 50 promised ICU beds now ready ↑

-

Calgary Herald (October 18, 2022) More than 50 school bus routes still without drivers as labour shortage drags on ↑

-

Beaumont News (October 19, 2022) WANTED: Lifeguards for Manluk Centre pool ↑

-

Lakeland Today (October 30, 2022) Oil and gas continues to see labour shortages; industry leader sees strong growth in short term ↑

-

ATB Financial (November 3, 2022) Construction Outlook Deteriorated in September ↑

-

Edmonton Journal (November 9, 2022) Feds, Alberta government to fund more than $470 million in new blue hydrogen energy complex ↑

-

CBC News (October 31, 2022) Women's health at risk as Lethbridge battles severe obstetrician shortage, doctors warn ↑

-

Red Deer Advocate (October 6, 2022) 8 more ICU beds now open at Red Deer hospital as staff recruitment efforts continue: AHS ↑

-

Meridian Source (October 19, 2022) Lloydminster Hospital Now Hiring ↑

-

Government of Alberta (October 4, 2022) Attracting investment to rural Alberta ↑

-

Government of Alberta (October 4, 2022) New housing on the way for Blackfoot families ↑

-

Strathmore Now (October 14, 2022) Clarification over Strathmore hospitals upcoming lab closure ↑

-

CTV News (September 2, 2022) Banff businesses hope to hire a few more workers before snow flies ↑

-

The Crag and Canyon (October 3, 2022) Over 200 jobs up for grabs at Banff Winter Hiring Fair ↑

-

Red Deer Advocate (October 5, 2022) Joffre solar plant now under construction ↑

-

Mountainview Today (October 29, 2022) Innisfail joins Alberta Advantage Immigration Program ↑

-

Edmonton Journal (November 3, 2022) Suncor reducing contractor work force by 20 per cent to improve safety, efficiency ↑

-

RMO Today (October 31, 2022) Company engaging public over wind turbine project in Northern Alberta ↑

-

Fort McMurrary Today (October 27,2022) Fort McMurray program makes it easier to recruit, keep newcomers to fill labour shortages ↑

-

Narctiy (October 11, 2022) Calgary Airport Is Hiring For A Lot Of Jobs & Some Pay Way More Than Minimum Wage ↑

-

Sidetrade (October 4, 2022) Global AI firm, Sidetrade, chooses Calgary for North America expansion ↑

-

Edmonton Journal (November 8, 2022) Feds, Alberta government to fund more than $470 million in new blue hydrogen energy complex ↑

-

Government of Alberta (October 3, 2022) Home ownership key to Indigenous housing project ↑

- Date modified: